With Gift Aid, for every pound given, the local church gets an extra 25p from HM Revenue & Customs which means donations go further – at no extra cost to the giver! All the giver needs to do is use a Gift Aid envelope or sign a simple declaration which you can download below.

Our Gift Aid Guide

Our Gift Aid Guide, available to download at the bottom of the page, has step-by-step instructions for running Gift Aid in your parish, written with advice from experienced treasurers. It has useful information for newcomers to Gift Aid, plus tips for old hands:

- Worked examples showing how to keep your Gift Aid records

- Guidance on how to claim using the HM Revenue & Customs online claim form

- How to run the Gift Aid Small Donations Scheme (GASDS)

- Frequently asked questions, practical tips and sample letters to parishioners

- Examples of ‘borderline cases’ from a fictional parish

- Links to further help on the web

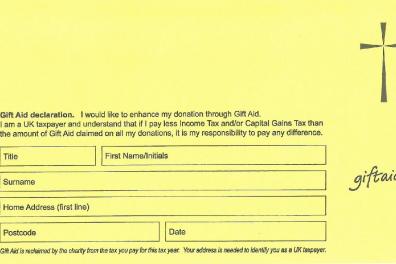

Gift Aid Declarations

Regular givers should be invited to complete a Gift Aid Declaration form so that you can reclaim the tax they have paid without any further work on the donor’s part. The required wording can be found in our Gift Aid Guide, downloadable from the bottom of this webpage.

Churches and charities are encouraged to include full forenames on Gift Aid Declarations, as HMRC is looking to see an improvement in the number of claims which include full forenames to help with eligibility checks.

It is possible to collect a donor’s Gift Aid declaration when the donation is made by email, online or verbally over the phone, without having to post a hard copy declaration form. See national church guidance.

A sponsorship form template, which includes a Gift Aid column for donors to simply tick, is downloadable below.

Gift Aid Small Donations Scheme (GASDS)

This scheme enables churches and charities to claim a top-up payment similar to Gift Aid on up to £8,000 a year on cash, contactless and now also chip & PIN donations up to and including £30 without the need for Gift Aid Declarations, although your church must also run a Gift Aid scheme in order to claim GASDS. Retrospective claims can be made back as far as 2 years from the end of the tax year in which the donation was made. Download our Gift Aid Guide (below) or visit the Church’s national GASDS guidance web page.

HMRC has confirmed that, where churches normally make use of the Gift Aid Small Donations Scheme (GASDS) in relation to small gifts given in weekly envelopes, it is happy to accept Gift Aid claims for separate weekly envelopes containing £30 or less or multiple gifts given in one envelope with a declaration stating how much was donated each week and the relevant dates, for example when a donor has missed attending church for a week or more.

Gift Aid claims process

HMRC has an online claims process requiring charities to provide information in a set way. Make sure you keep your records in the right way for easier claiming and that you are set up to make claims.

See National Church Gift Aid claims guidance and HMRC schedule requirements.

We need envelopes . . !

What about occasional worshippers and visitors? They too can use Gift Aid to increase the value of their donation. The most common way to do this is by one-off Gift Aid envelopes. Every parish should have a supply!

Gift Aid envelopes help people make tax-efficient gifts to your church. All you need to do is add the name of your PCC to each envelope and put them out in church.

We provide a service to supply parishes in Bath & Wells, for quantities up to 1,000. The envelopes are £6.00 per 100. Visit our online shop to order your envelopes. If you are unable to make a card payment, complete this form to pay by BACS or cheque.

For larger quantities, it’s cheaper to buy from commercial suppliers such as those listed below. They can also print a picture or church logo on your envelopes for you.

Magazine article to encourage Gift Aided donations

Want to encourage Gift Aid take-up in your church? We have written an article, which you can download below, which may help.

Get the Gift Aid logo

The ‘Gift Aid it’ logo provides a positive, friendly and simple way of drawing attention to Gift Aid on your church’s publicity. You can use the logo without any charge. Download either of the logos below to copy and paste it into your own documents.

More Gift Aid help

We will happily give advice on ways of increasing Gift Aid take-up, or put you in touch with others who have made it work for them.

You can also get authoritative information directly from the HM Revenue and Customs Gift Aid website which also allows you to download the relevant documents. Or you can phone HMRC Charities Helpline on 0300 123 1073 and ask to be forwarded to the Outreach team (Monday to Friday 8.30 am – 5.00 pm, closed weekends & Bank Holidays).

Who to contact

Natalie Wainwright, Lead Giving and Funding Adviser

Sue Whitehead, Deanery and Parish Support Administrator

Downloads

Gift Aid logo - black type on white background

Gift Aid logo - white type on black background

Regular giving form - with Gift Aid declaration and standing order

Gift Aid magazine article Nov 2020

GASDS sample note from treasurer for notice sheet re anonymous givers through offering bag/plate